Know About Corporate Tax Registration In UAE

As per the FTA, companies with a financial year starting from January 2023 are required to register for the UAE corporate tax now

How to register for a Corporate Tax through the Emara Tax Platform ?

Relevant businesses are required to make their UAE corporate tax registration through the Emara Tax platform. You can register for corporate tax in the following steps:

- Login to the EmaraTax account using your login credentials or using UAE Pass. If you do not have an EmaraTax account, you can sign-up for an account by clicking the sign-up button. If you have forgotten your password, you can use the “forgot password” feature to reset your password.

- On successful login, the Taxable Person list screen is displayed. It displays the list of the Taxable Person linked to your EmaraTax user profile. If there are no Taxable Person linked to your user profile, this list will be empty and you would need to create a Taxable Person. To create a new Taxable Person, enter the mandatory details and click ‘create’. The new taxable person will be displayed in the list.

- Select the Taxable Person from the list and click ‘View’ to open the dashboard. Click ‘Register’ on the Corporate Tax tile within the Taxable Person dashboard to initiate the Corporate Tax registration application

- A screen will appear with guidelines and instructions. Read the guidelines and instructions for CT Registration and mark the checkbox to confirm

- Click ‘Start’ to initiate the CT Registration application

- Select the Entity Type of your business from the list in the entity details section. Note that the input fields in this section may vary based on the entity type selected.

- After completing all the mandatory fields, click ‘Next Step’ to save and proceed to the ‘Identification Details’ section.

- Depending on the ‘Entity Type’ selected, you are required to provide the main trade license details in the identification details section.

- Click on ‘Add Business Activities’ to enter all the business activity information associated with the trade license. Enter the mandatory business activity information and click on Add

- Click on ‘Add Owners’ to enter all the owners that have 25% or more ownership in the entity being registered. Enter the mandatory owner information and click on Add

- Select ‘Yes’, if you have one or more branches, and add the local branch details. For each branch, enter the trade license details and associated business activities and owners list

- After completing all mandatory fields, click ‘Next Step’ to save and proceed to the ‘Contact Details’ section

- Enter the registered address details of the business

- After completing all mandatory fields, click ‘Next Step’ to save and proceed to the ‘Authorized Signatory’ section

- Click ‘Add Authorized Signatory’ to enter the Authorized Signatory details

- After entering the required information for an Authorized Signatory, click ‘Add’

- After completing all mandatory fields, click ‘Next Step’ to save and proceed to the ‘Review and Declaration’ section

- After carefully reviewing all of the information entered on the application, mark the checkbox to declare the correctness of the information provided in the application

- Click ‘Submit’ to submit the Corporate Tax Registration application

Timeline For Registering, Filing And Paying Corporate Tax

All Taxable Persons (including Free Zone Persons) will be required to register for Corporate Tax and obtain a Corporate Tax Registration Number. The Federal Tax Authority may also request certain Exempt Persons to register for Corporate Tax.

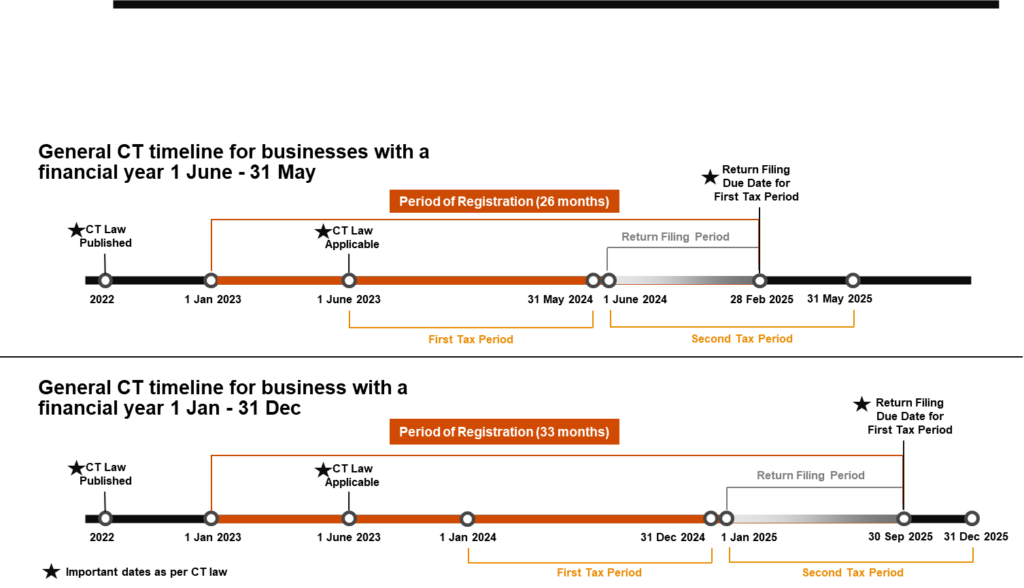

Taxable Persons are required to file a Corporate Tax return for each Tax Period within 9 months from the end of the relevant period. The same deadline would generally apply for the payment of any Corporate Tax due in respect of the Tax Period for which a return is filed.

As per the illustration above given by Federal Tax Authority the period of registration for businesses with a financial year from 1st June till 31st May will be from 1st January 2023 to 28th February 2025 (26 months).

For business with a financial year from 1st January to 31st December, the period of registration will be from 1st January 2023 to 30th September 2025 (33 months).

Let's Get Started

We value our clients, students, trainers and our commitment to provide the highest standard of training to individuals and Corporates of all levels

Contact Us Form

For Latest Articles We Publish

Please Subscribe Now